While customers argue over whether a 15%, 18%, or 20% tip is standard, you’re probably having conversations about tipped minimum wage: whether it’s going up in your region, the tip credit, and how rising labor costs will affect your bottom line.

As a restaurant owner, you already know rising minimum wage rates have been a big impact on the food service industry. But now, with increased labor costs, it’s more important than ever to know what changes are coming in the months and years ahead, so you can manage your operating expenses and payroll.

And it’s not just the minimum wage debate you should be paying attention to. You should also be keeping an eye on changes to the tipped minimum wage for servers – which could be eventually eliminated by 2027.

What Is Tipped Minimum Wage?

Tipped minimum wage is an hourly pay rate for employees who receive tips on a regular basis, like servers and bartenders. The minimum wage for tipped employees is generally lower than the general minimum wage.

Currently, the U.S. federal government requires that tipped employees are paid at least $2.13 per hour in direct wages, as long as this amount equals the federal hourly minimum wage when combined with tips. If the employer’s direct wages of $2.13 per hour, plus the employee’s tips do not equal the federal minimum hourly wage, the employer must make up the difference.

While this may seem fairly straightforward, it’s important to note that many states require higher direct hourly wages for tipped employees. And that’s where things get tricky, because there are frequent changes to the server minimum wage in different parts of the country.

That’s why you need to know what’s happening now with tipped minimum wage, what could happen in the future, and how to keep your doors open no matter what changes come your way.

This article will tell you:

- How rising minimum wage affects tipped minimum wage

- Current minimum wage for tipped employees by state

- Current minimum wage for tipped employees by province

- How rising tipped minimum wage for servers affects restaurants and employees

- How to prepare for increased labor costs

Who Is Considered a Tipped Employee?

The Department of Labor (DOL) defines a tipped employee as someone who “customarily and regularly receives more than $30 per month in tips” – although certain states have established slightly different standards. You can view state definitions of tipped employees on the DOL website.

While tipped employees represent more than just restaurant workers (think valets, gaming dealers, porters/bellhops, etc.), research from labor economist Sylvia Allegretto shows that the majority (60%) of tipped workers in the U.S. are servers and bartenders. This means restaurant owners and their employees are affected the most by changes to tipped minimum wage rates.

How Rising Minimum Wage Affects Tipped Minimum Wage

First off, what is minimum wage? In the U.S., the federal minimum wage is $7.25 per hour. However, for people who receive tips as part of their income, that total wage can come from different sources.

Why?

The Fair Labor Standards Act (FLSA) lets businesses apply a tip credit to the minimum wage of tipped employees, paying them a lower wage. Businesses do not pay full minimum wage, and then later receive a government reimbursement. An employer simply calculates a lower wage during payroll – but only if the tips received by an employee combined with an hourly wage add up to at least $7.25 an hour.

What Is a Tip Credit?

A tip credit is the maximum portion of the minimum wage that employers are not required to pay tipped employees. The tip credit portion of their wage is counted as being paid through tips. When an employer applies a tip credit, they subtract the tip credit amount from the federal minimum wage in payroll. What’s left is the tipped minimum wage.

Federal minimum wage (base) – tip credit = hourly tipped minimum wage

The maximum tip credit in the U.S. is $5.12, which means the tipped minimum wage (paid by the employer) in some regions is $2.13. The tips employees receive from customers then bump them up to minimum wage or higher.

$7.25 – $5.12 = $2.13 / hour

What You Need to Know About the Tip Credit

- Employers need to notify employees that they are being paid a tipped minimum wage, either verbally or in writing

- If the tips earned by the employee aren’t enough to bring them to minimum wage, the employer must make up the difference

- States often set their own tip credit, which can be higher than the federal maximum of $5.12 (just like the state minimum wage can be higher), but the tip credit cannot reduce a wage to less than $2.13 per hour

- Overtime has to be calculated based on the full minimum wage, not the tipped minimum wage

Did You Know?

Tipped minimum wage used to be set at 50% of general minimum wage. And whenever the general minimum wage went up, so did the tipped minimum wage. But in 1996, the tipped minimum wage was uncoupled from federal minimum wage and kept at $2.13, where it had been since 1991. While the general minimum wage has risen since 1996 – from $5.15 to $7.25 – federal tipped employee minimum wage has stayed the same.

Which States Have Seen Changes to Tipped Minimum Wage?

Recent increases to the minimum wage rate have affected tipped minimum wage, and the tip credit differently, depending on where your restaurant is located.

If your restaurant is located in the U.S., your state will fall into one of three categories:

- States that require employers to pay tipped employees full state minimum wage before tips

- States that require employers to pay tipped employees a base minimum wage above federal tipped minimum wage of $2.13 per hour (tip credit amount varies)

- States that have the same base minimum wage payment as federal tipped minimum wage of $2.13 per hour (tip credit amount varies)

Here’s where tipped minimum wage by state and/or the tip credit have risen in each of the three categories:

Tipped Minimum Wage in States Where Tipped Employees Receive Full State Minimum Wage

These states don’t allow a tip credit. Tipped workers make the same as non-tipped workers. This means that when the minimum wage rises in these states, restaurateurs also have to raise the wage for tipped employees. These are the 2025 minimum hourly wage rates for states that require employers to pay tipped employees full state minimum wage before tips:

Alaska: $11.91/hour

California*: $16.50/hour for all employees ($17.27/hour in Los Angeles and $18.67/hour in San Francisco) until June 30, 2025.

Minnesota*: $11.13/hour for all employees, except those 20 years of age or younger who qualify for a $9.08/hour 90-day training wage.

Montana: $10.55/hour (for businesses with gross annual sales over $110,000); $4.00 (if the business has gross annual sales of $110,000 or less).

Nevada: $12.00/hour

Oregon*: $14.20/hour (Standard), $15.45 (Portland Metro area), $13.20 (Non-Urban Counties).

Washington*: $16.66/hour ($20.76/hour in Seattle).

*Different rates apply to certain counties and municipalities in this state. Some are noted in the section below. Get more info here.

Tipped Minimum Wage in States Where Tipped Employees Receive Above Federal Minimum Wage

These are the 2025 minimum hourly wage rates, maximum tip credits, and minimum cash wages for states where tipped employees receive more than the federal tipped minimum wage:

Arizona**: $11.70 tipped employee minimum wage; $3.00 tip credit (basic combined cash and tip minimum wage rate = $14.70 effective January 1, 2025).

Arkansas: $2.63 tipped employee minimum wage; $8.37 tip credit (basic combined cash and tip minimum wage rate = $11.00).

Colorado**: $11.79 tipped employee minimum wage; $3.02 tip credit (basic combined cash and tip minimum wage rate = $14.81 effective January 1, 2025).

Connecticut:

- Tipped employees other than bartenders: $6.38 tipped employee minimum wage; $9.97 tip credit.

- Bartenders who customarily receive tips: $8.23 tipped employee minimum wage; $8.12 tip credit.

- All employees must make at least $16.35 per hour effective January 1, 2025 (basic combined cash and tip minimum wage).

Delaware: $2.23 tipped employee minimum wage; $12.77 tip credit (basic combined cash and tip minimum wage rate = $15).

District of Columbia: $10.00 tipped employee minimum wage; $7.50 tip credit (basic combined cash and tip minimum wage rate = $17.50) until July 1, 2025, when the tipped minimum wage increases to $12.00 per hour. The District’s general minimum wage will also increase in July.

Florida: $9.98 tipped employee minimum wage; $3.02 tip credit (basic combined cash and tip minimum wage rate = $13.00). Scheduled to increase the minimum wage by $1.00 every year on September 30th, 2024 until reaching $15.00 on September 30, 2026.

Hawaii: $12.75 tipped employee minimum wage; $1.25 tip credit (basic combined cash and tip minimum wage rate = $14.00 effective January 1, 2024). Note: The tip credit in Hawaii is only allowed if the combined amount the employee receives from the employer and from tips is at least $7.00 more than the state’s general minimum wage).

Idaho: $3.35 tipped employee minimum wage; $3.90 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Illinois: $9.00 tipped employee minimum wage; $6.00 tip credit (basic combined cash and tip minimum wage rate = $15.00).

Iowa: $4.35 tipped employee minimum wage; $2.90 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Maine: $7.33 tipped employee minimum wage; $7.32 tip credit (basic combined cash and tip minimum wage rate = $14.65).

Maryland: $3.63 tipped employee minimum wage; $11.37 tip credit (basic combined cash and tip minimum wage rate = $15.00 effective January 1, 2024).

Massachusetts: $6.75 tipped employee minimum wage; $8.25 tip credit (basic combined cash and tip minimum wage rate = $15.00).

Michigan: $3.93 tipped employee minimum wage; $6.40 tip credit (basic combined cash and tip minimum wage rate = $10.33) until February 21, 2025, when the tipped minimum wage will increase to $4.01/hour and Michigan’s general minimum wage will increase to $10.56/hour.

Missouri: $6.88 tipped employee minimum wage; $6.87 tip credit (basic combined cash and tip minimum wage rate = $13.75).

New Hampshire: $3.27 tipped employee minimum wage; $3.98 tip credit (basic combined cash and tip minimum wage rate = $7.25).

New Jersey: $5.62 tipped employee minimum wage; $9.87 tip credit (basic combined cash and tip minimum wage rate = $15.49) for most employees.

New Mexico**: $3.00 tipped employee minimum wage; 9.00 tip credit (basic combined cash and tip minimum wage rate = $12.00).

New York**: Pay structure varies by county, number of employees, and type of tipped employee. See here for 2025 rates or below for more details.

North Dakota: $4.86 tipped employee minimum wage; $2.39 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Ohio: $5.35 tipped employee minimum wage; $5.35 tip credit (basic combined cash and tip minimum wage rate = $10.70) Note: These figures apply to employees of businesses with annual gross receipts of $372,000 or more.

Oklahoma: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25) Note: For businesses with 10 full-time employees at any one location who have gross annual sales of $100,000 or less, the basic minimum rate is $2.00 per hour.

Pennsylvania: $2.83 tipped employee minimum wage; $4.42 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Rhode Island: $3.89 tipped employee minimum wage; $10.11 tip credit (basic combined cash and tip minimum wage rate = $15.00).

South Dakota: $5.75 tipped employee minimum wage; $5.75 tip credit (basic combined cash and tip minimum wage rate = $11.50.)

Vermont: $7.01 tipped employee minimum wage; $7.00 tip credit (basic combined cash and tip minimum wage rate = $14.01) Note: A tipped employee in Vermont is an employee of a hotel, motel, tourist place, or restaurant who customarily and regularly receives more than $120.00 per month in tips.

Wisconsin: $2.33 tipped employee minimum wage; $4.92 tip credit (basic combined cash and tip minimum wage rate = $7.25)

West Virginia: $2.62 tipped employee minimum wage; $6.13 tip credit (basic combined cash and tip minimum wage rate = $8.75)*

*Different rates apply to certain counties and municipalities in this state. Some rates for minimum wage for tipped employees by state are noted in the section below. Get more info on Arizona here or New York here.

Tipped Minimum Wage in States Where Tipped Employees Receive Federal Minimum Wage

These are the 2025 rates for states where the sever minimum wage is the same as that required under the federal Fair Labor Standards Act ($2.13 per hour):

Alabama: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Georgia: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Indiana: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Kansas: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Kentucky: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Louisiana: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Mississippi: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25).

Nebraska: $2.13 tipped employee minimum wage; $11.37 tip credit (basic combined cash and tip minimum wage rate = $13.50.)

North Carolina: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25) Note: A tip credit is not permitted in North Carolina unless the employer obtains from each employee, either monthly or each pay period, a signed certification of the amount of tips received.

South Carolina: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25)

Tennessee: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25)

Texas: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25)

Utah: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25)

Virginia: $2.13 tipped employee minimum wage; $9.87 tip credit (basic combined cash and tip minimum wage rate = $12.00)

Wyoming: $2.13 tipped employee minimum wage; $5.12 tip credit (basic combined cash and tip minimum wage rate = $7.25)

Keep in mind that Alabama, Louisiana, Mississippi, South Carolina, and Tennessee do not have state minimum wage laws. And while Georgia has a state minimum wage law, it does not apply to tipped employees.

New York City tipped minimum wage: The details

New York has several minimum wage increases slated for 2025 and beyond.

For the hospitality industry, the tipped minimum wage as of January 1, 2025 is as follows:

| New York City | Long Island and Westchester County | Remainder of New York State | |

| Service Employees | $13.75 tipped minimum wage | $13.75 tipped minimum wage | $12.90 tipped minimum wage |

| $2.75 tip credit | $2.75 tip credit | $2.60 tip credit | |

| Foodservice Workers | $11.00 tipped minimum wage | $11.00 tipped minimum wage | $10.35 tipped minimum wage |

| $5.50 tip credit | $5.50 tip credit | $5.15 tip credit |

According to the New York State Department of Labor, it’s important to note that the state minimum wage will be $16.50 per hour effective January 1, 2025, for New York City and the counties of Nassau, Suffolk and Westchester, and $15.50 per hour for the rest of the state.

Chicago tipped minimum wage: The details

Currently, the minimum wage in Chicago is $16.20 per hour, with the tipped minimum wage for Chicago being $11.02 for employers with 4 or more workers. If the tipped worker’s wage plus tips does not equal the minimum wage, the employer must make up the difference. However, it’s important to note that Chicago is looking to eliminate the waiter and waitress minimum wage over the next several years. On July 1, 2024, the tipped minimum wage increased to 68% of the full minimum wage until it reaches 100% on July 1, 2028.

Los Angeles tipped minimum wage: The details

Since California doesn’t allow a tip credit, the tipped minimum wage for Los Angeles is $17.27 until June 30, 2025, when it’s due to change. For more information about local wage increases in every California city (as well as other cities with their own regulations), see UC Berkeley’s Inventory of US City and County Minimum Wage Ordinances.

Tipped Minimum Wage in Canada

Meanwhile, in Canada, most provinces and territories don’t have a tipped minimum wage, as workers who receive regular tips are paid the same as non-tipped workers.

The general minimum wage in each region of Canada is different. Let’s take a look at what is the minimum wage for servers for 2025.

Provinces and Territories with No Tipped Minimum Wage

Alberta: $15.00 effective as of June 26, 2019.

Manitoba: $15.80 effective October 1, 2024.

New Brunswick: $15.30 effective as of April 1, 2024. This figure is adjusted annually on April 1 relative to the Consumer Price Index.

Newfoundland and Labrador: $15.60 effective as of April 1, 2024. This figure will be adjusted annually on April 1, according to the Consumer Price Index.

Northwest Territories: $16.70 effective as of September 1, 2024.

Nova Scotia: $15.20 effective as of April 1, 2024.

Nunavut: $19.00 effective as of January 1, 2024.

Prince Edward Island: $16.00 effective as of October 1, 2024.

Saskatchewan: $15.00 effective as of October 1, 2024.

Yukon: $17.59 effective as of April 1, 2024. This figure is adjusted annually on April 1 relative to the Consumer Price Index.

Provinces with Tipped Minimum Wage

Quebec has a lower minimum wage for tipped employees, which is $12.60 as of May 1, 2024.

How Rising Tipped Minimum Wage Affects Restaurants

Now that you know what is the minimum wage for servers is in the state or province applicable to you, let’s take a look at how tipped minimum wage affects your business. As a restaurant owner, labor is one of your most substantial costs. Rising wages – whether for tipped or non-tipped employees – will lead to an increase in these costs, which will cause shrinking profits in the short term. And the more staff you have, the more pain you’ll feel.

Beyond government-legislated increases in labor costs, you may also need to increase wages for your entire team, so that you can maintain a fair pay gap between more experienced, non-tipped staff and the staff making tipped minimum wage plus significant daily tips.

You may also consider creating a new or adjusting an existing tip pool for more even distribution across your team – just make sure you’re up to date on the tip pooling laws in your state. This strategy may include tipping out. So what does tip out mean? It involves your servers receiving a set percentage of their earned tips and other non-tipped workers getting some of those tips. You’ll also need to adjust your restaurant payroll for reporting tip credits, as well as for higher contributions to workers’ compensation and liability insurance.

Shrinking profits don’t need to be your long-term narrative if you can adapt. Find ways to keep costs down, and streamline your operations.

How Rising Tipped Minimum Wage Affects Employees

Restaurateurs debate this topic with passion. Some argue that a wage increase for servers and bartenders means a more dependable income that is less dependent on the customers they serve on any given day. On the other hand, others suggest that a rise in tipped minimum wage could have a long-term negative effect on tips.

The argument against raising the minimum wage for tipped employees goes like this: if employers increase menu prices to offset additional labor costs, customers may react by tipping less or dining less – both of which affect a tipped employee’s overall wage. And if employers make cuts to shifts or operating hours, tipped employees could see fewer working hours.

Some research even suggests that raising tipped wages doesn’t increase workers’ total earnings, because tips fall as wages rise.

So How Much Do Servers Make, Really?

For servers and bartenders, income can vary widely depending on the venue type and location. Fine dining servers in a big city like San Francisco will make a lot more in tips than a server in a small town diner, since they will yield vastly different sales (among other factors).

In 2023, the U.S. Bureau of Labor Statistics estimated that waiters and waitresses earned an average salary of $31,940, while restaurant cooks made $34,320 and bartenders made $31,510. But this isn’t the whole picture, since an estimated 40% of tips are never reported.

However, it’s important to note that rising costs due to inflation have dramatically reduced the number of tips restaurant workers are bringing in. In fact, in 2021, 56% of consumers were found to typically tip servers 20% of their check, but in 2024, only 34% of diners tipped 20%. Another study by PlayUSA found that 17% of Americans are tipping less because of the economy, while only 10% are tipping more.

It’s important to keep in mind that many tipped workers are likely to continue to feel the effects of this reduced income in 2025 and beyond.

Are More Changes Coming for Tipped Minimum Wage?

Ongoing controversy rages over what some see as a two-tier wage system that should be eliminated. This is a conversation that is set to continue well into 2025, as the Congressional Democrats continue to fight for the Raise the Wage Act, which aims to bring the minimum wage to $15.00, and to continue increasing the tipped minimum wage until 2027, when the tipped minimum wage would be eliminated entirely.

There’s no question that the new minimum wage legislation could have a big impact on restaurants. However, it’s not all bad news. Preparing for and dealing with rising tipped minimum wage may reveal creative ways to cut costs that will ultimately help your business thrive. You just have to know where to look for them.

Below are five ways to deal with the rising cost of labor.

How to Prepare for Increased Labor Costs

To deal with higher costs, many restaurateurs often do one of two things:

- Raise menu prices across the board

- Fire staff

But these tactics are risky business. You could chase away customers and lose quality servers and bartenders – which isn’t ideal in an industry as competitive as the restaurant industry.

So if raising prices and firing staff aren’t the best solutions, what are they?

Here are five practical strategies you can use right now to help you deal with rising restaurant minimum wage:

- Reduce your fixed costs

- Experiment with new pricing strategies

- Invest in the right technology

- Redesign your menu

- Focus on staff retention

Here we’ll tell you how to implement these strategies to better respond to the reasons for increased labor costs, make more money, and ultimately see less of a shrinking profit margin in the long run.

1. Reduce Your Fixed Costs

This is number one on the list because – even though it may seem obvious – reducing fixed operating costs often skips our attention because fixed costs aren’t constantly fluctuating, like other costs in the restaurant business that have to be continually managed.

But small, fixed costs really add up – and minor adjustments can leave you with more room in your budget.

For example, is another cable provider offering a promotional deal that will save you $100 a month for switching? Would hiring different night cleaners cut several hundred dollars from your weekly bill?

Also, it can be worthwhile to look at your expenses and determine which ones are necessary versus which ones are luxury: extra TV channels your bar doesn’t use or knife sharpening services. Some restaurants have back-of-house staff sharpen their own knives, saving the business from outsourcing.

Last, look at your inventory (try to contain your excitement).

Inventory management may be time-consuming, but it’s one of the best ways to figure out what you’re spending on your cost of goods sold (CoGS) – every month and during certain holidays or special events – and how you could be more efficient. Turn to your POS and inventory management software to help with your deep dive into these costs, in terms of how much you’re using and where you may be able to order less.

2. Create a Smart Pricing Strategy

While knee-jerk price increases aren’t a great idea, you can raise prices mindfully with the right approach. Plan price increases according to your POS sales data by analyzing:

- Which items sell best

- Your most popular menu modifiers

- Which items sell best during certain times of the day

When you analyze sales data alongside the cost of your inventory, you can increase prices of high-volume, high-margin items only. Coffees and sodas, for instance, sell at a higher volume and at a higher margin, but the rise in price will also put less of a burden on your customers’ pockets.

Tier pricing is also a great option. Tier pricing lets you charge customers different prices for different options. For example, you likely have customers who order their meals to go and others who want a sit down dining experience. With tier pricing, you would charge your to-go customers less and give them smaller portion sizes.

It’s also a good idea to check out your competitors. Do a competitive analysis of restaurants that are similar to yours and note what they charge for comparable items. Do some competitors sell their Thai chicken wrap for $2 more? Customers in your area may have already come to expect the higher price tag, but you’re just not taking advantage of it.

3. Invest in the Right Technology

Sometimes you have to spend money to make – and save – money.

Your restaurant POS system should be your money-saving hub. With POS data and analytics, you can give your business the tools it needs to deal with rising labor costs.

Knock off some low-hanging fruit simply by reviewing your labor reports and analytics. Surprisingly, many restaurant owners (39%) are not using their POS to view labor reports. Restaurateurs who don’t use data to make scheduling decisions for servers and bartenders are missing out on some efficiencies that could save them significant costs.

Check your labor reports regularly against seasons, holidays, times of day, etc. to ensure you schedule the exact amount of staff when you need them – and not when you don’t. You may have over projected your kitchen staffing needs during last year’s Super Bowl event, but your labor report can remind you not to schedule as many bartenders in the future. Some solutions, like TouchBistro Labor Management, will forecast your staffing needs for you, helping you avoid overstaffing and eliminating unnecessary overtime expenses.

You can also save in smaller ways that will build up over time. Stagger server start times – when everyone is just starting dinner and only ordering drinks – and end times, when you know the rush starts to taper off. Scheduling the bulk of your dinner staff just an hour later and cutting them an hour earlier can save a lot of labor costs in the long run. Plus, servers don’t typically want to be on the floor when there aren’t tips to be made, so these changes may be appreciated.

4. Perfect Your Menu Design – with Psychology

Have you ever noticed how grocery stores display their produce? Certain items are usually always in your line of sight – on shelves or special displays. And for good reason: these are high-margin items that store owners want you to buy.

You can and should do the same with your menus. Place high-margin items where they’re the most visible to the customer. But where exactly is the best place to put them? According to Aaron Allen – a global restaurant consultant and expert on the psychology of menu design – when we look at a menu our eyes go to the middle first, then the top right, and finally the top left. This is known as the Golden Triangle, and you should place meals with the highest profit margin there.

But perfecting your menu isn’t only about putting menu items in the right place. The psychology of design includes choice of color, storytelling, the use of nostalgia, clever descriptions, decoy dishes, and the number of options.

Decoy dishes are expensive items placed at the top of menus, so diners perceive other items as better value for money.

As for the number of options, conventional wisdom suggests that more choice is better – but this isn’t always true. Too much choice can cause stress and lead to customers not making a decision at all. That’s why smart restaurateurs limit choices by offering only seven dishes in each section, so diners feel in control.

5. Focus on Retaining Staff

It’s no secret that staff turnover rates in the restaurant industry are high. According to TouchBistro’s 2025 State of Restaurant Report, the average restaurant turnover rate for the restaurant industry is 26%, suggesting that staff retention is still a major problem across the U.S.

But here’s the thing: retaining staff is one of the best ways to keep your labor costs down over the long-term. If you invest and look after your current team, they’ll be happier, work harder, deliver better customer service, and look after you and your bottom line.

But what can you do to keep your staff happy? Here are two ways:

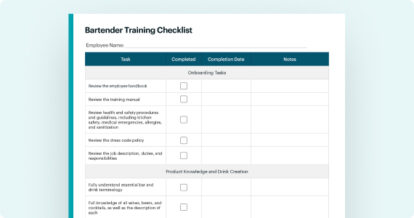

Proper Training

For new hires, you may believe in the “get your hands dirty approach.” You give employees quick training, and then let them jump in the deep end. But mistakes can – and do – happen, which can cost you a lot of money.

Instead, make sure to cover your bases from the start:

- Train employees on how to properly use your POS and payment terminals

- Be clear about your customer service standards

- Implement a staff shadowing procedure

- Provide new staff members with an employee handbook

Your employee handbook is your point of reference for employees. It provides employees with all the information they need about how things work in your restaurant, from the day they start – which will save your business from human error that could otherwise cost you a lot of money.

Download your customizable template now to start your own handbook for your restaurant!

Recognize and Reward Employees

How would you feel if you always put your blood, sweat, and tears into a job, but were never recognized or rewarded?

(Never mind. As a business owner, you know all too well.)

Your servers and bartenders will be more likely to stay if you recognize them for hard work and excellence. And, if you reward them for their excellence, they’ll repeat their excellent behavior. Over. And over. And over. Again.

For you, this means a better customer experience and more profits.

But how do you recognize and reward such excellence? Here are some ways:

- Introduce an employee of the month award to motivate your employees

- Create a daily reward for the server who has the highest sales or most upsells at the end of their shift

- Provide small rewards, like a free meal or even public recognition for their efforts

- Show that there’s room for advancement (could a server be promoted to a manager position?)

- Invest in career development (would a bartender benefit from taking a mixology class or entering a bartending competition?)

Nothing rewards an employee more than professional advancement – and you’ll be creating some genuine loyalty in the process.

You can’t control the rate of tipped minimum wage by state or province. As wages continue to rise, you’re guaranteed to see increased labor costs that impact your bottom line.

But the long-term impact doesn’t have to lead to shrinking margins or unhappy servers. If you focus on what you can control within your business and take a strategic approach, you can tip the scales, remaining a profitable business and a great place to work.

Download your free employee handbook template

Sign up for our free weekly TouchBistro Newsletter