Restaurateurs are feeling the heat of cyber threats in today’s tech-enabled world. There are major benefits to taking your operations online, but as technology becomes more prevalent in restaurants, the risk of a cyber attack is also greater. As a result, it’s important to keep restaurant cyber security top of mind and take the appropriate precautions to protect your business.

The good news? There’s a lifeline you might not have explored yet: cyber insurance for restaurants. Think of it like your shield against potential digital disasters, safeguarding your business so you can focus on what you do best – serving up culinary goodness to your guests.

In this guide to keeping your restaurant data safe, we’ll cover:

- Why restaurant cyber security matters

- The basics of cyber insurance for small business

- What’s covered by cyber insurance

- 5 reasons why you should have cyber insurance

The Importance of Restaurant Cyber Security

In a world where a cyber attack happens every 39 seconds, your restaurant is no longer just a cozy spot for diners to gather – it’s also a potential target for cyber crime. From taking online reservations to handling customer payments data, every digital interaction you engage in comes with a security risk.

This might sound more like the plot of a movie than real life, but no restaurant is immune from the risk of a data breach. Back in 2018, Panera Bread fell victim to a cyber attack in which customer names, email addresses, and even physical addresses were leaked online over a staggering eight-month period.

The Panera Bread incident was far from isolated. As Nation’s Restaurant News reported, “McDonald’s was hit by a data breach in 2021, while DoorDash’s [2019] breach affected nearly five million people. More recently, Five Guys reported a breach in late 2022 that impacted job applicants, while Yum Brands experienced a ransomware attack in the U.K. in January [2023].”

These events aren’t just cautionary tales, they’re wakeup calls to get serious about restaurant data protection, regardless of whether you’re a big-name brand or a single-venue operation. According to Verizon, 43% of all cyber attacks are actually aimed at small businesses. This is because cyber criminals see these companies (including small restaurants) as easy targets that lack the robust security measures of larger enterprises.

But it’s not all gloom and doom, because there are a lot of things you can do to safeguard your business against these risks. Next, we’ll talk about one excellent way to protect your restaurant: cyber insurance.

What is Cyber Insurance?

You’re likely familiar with restaurant insurance for general liabilities, commercial property, and workers’ compensation. But how are you keeping your restaurant data safe? That’s where cyber insurance comes into the picture.

Cyber insurance is a solution designed to help businesses mitigate the impacts of cyber crime like data breaches and extortion – the effects of which can be devastating. Considering that the average data breach costs a company $9.4 million in America and $7.3 million in Canada, investing in cyber insurance for small business is highly worthwhile.

What Does Cyber Insurance Cover?

Here are just a few common incidents typically covered by cyber insurance:

- Breaches of confidential data: This entails the loss of or unauthorized access to sensitive or personal information.

- Cyber extortion: Ever heard of ransomware? This type of attack involves threats to compromise your data or restrict your access to it unless you make a hefty payment to cyber criminals.

- Technology disruptions: This could include your online ordering system suddenly becoming inaccessible due to a technology failure or cyber attack.

In all of these cases, having cyber insurance for restaurants can help you cope with the fallout, ensuring your venue stays operational.

5 Reasons Restaurants Should Have Cyber Insurance

We’ve now walked through why restaurant cyber security matters, as well as the basics of cyber insurance. Now, let’s explore five reasons to invest in cyber security services for restaurants, such as insurance.

1. Protecting Customer Data

Restaurants collect and store a treasure trove of sensitive customer information, including credit card details and personal data for reservations, online orders, and reward programs. However, with great amounts of data comes great responsibility.

Research shows that websites experience an average of 94 attacks daily. If a data breach of your site or another digital platform occurs, your restaurant and customers could suffer severe consequences, like identity theft or financial loss. Cyber insurance acts as a shield, covering the costs associated with data breaches, including legal fees, customer notifications, and credit monitoring services.

In a time where data privacy concerns are at the forefront of consumers’ minds, having cyber insurance also demonstrates your commitment to restaurant data protection and safeguarding your customers’ information. It shows that you take their privacy seriously and are prepared to handle any potential threats with diligence and care. This sense of security can foster stronger loyalty and trust among your diners.

2. Securing Point-of-Sale Systems

Point-of-sale (POS) systems are the heartbeat of any restaurant, handling transactions and storing payment information. Cyber criminals can target these systems, seeking to exploit vulnerabilities and compromise financial data. This is why POS system security must be on your radar.

Imagine that a cyber criminal has gained unauthorized access to your POS, installing malware designed to capture payment card information during transactions. Without you or your employees realizing, every time a customer swipes their card to pay for a meal, the malware silently captures their sensitive financial data.

Cyber insurance provides financial protection in case of a POS system breach, ensuring that your business can recover from the aftermath and upgrade your security measures.

3. Preventing Business Interruption

Cyber attacks not only hurt your restaurant’s finances, but the operational fallout can also be crippling. Restaurants rely on digital systems for critical functions like inventory management, employee scheduling, and communication. If a restaurant network security breach takes down one of these systems, it can cause a serious interruption to your business.

For instance, say you’re gearing up for a busy week when your inventory system suddenly goes offline due to a cyber attack. You can no longer access essential information about ingredient levels and supplier contacts. Without real-time visibility into your stock, your kitchen staff struggle to prepare dishes efficiently, leading to delays, customer complaints, and food waste. Meanwhile, your servers are in the dark about which menu items are 86’d, resulting in incorrect orders and more frustrated guests.

Cyber insurance can help mitigate this by covering the costs associated with lost revenue during downtime, expenses incurred to restore operations, and even costs related to notifying customers about the disruption.

4. Mitigating Reputation Damage

The time, effort, and cost to open a restaurant are significant, but everything you’ve worked for can be at risk if a cyber attack occurs. Beyond the short-term impact of a restaurant network security breach, the long-term effects can break your business, specifically when it comes to your reputation.

Research shows that 66% of consumers would not trust a business after a data breach. History demonstrates that the impact on customer trust is real. As Restaurant Dive reported, “A breach at [the quick service restaurant] Sonic, which was reported in 2017, led to five million payment card accounts to appear on the dark web as part of a fire sale. Sonic later settled a $4.3 million class-action lawsuit brought on by customers.”

While it can be difficult to rebuild trust, cyber insurance often includes coverage for public relations efforts to manage the aftermath of a breach and work to repair your restaurant’s image. This can be instrumental in reassuring customers that you’re taking proactive steps to address and rectify the situation.

5. Meeting Legal and Regulatory Requirements

With the increasing prevalence of data protection laws, restaurants can face severe consequences for failing to safeguard customer data.

For instance, the General Data Protection Regulation (GDPR), which was implemented in the European Union (EU) in 2018, carries stiff penalties, even for businesses outside of the EU that handle the data of EU residents. Failure to comply with the GDPR can result in fines of up to 4% of a restaurant’s annual global revenue or €20 million, whichever is higher.

Many American states also have data protection laws, such as the California Consumer Privacy Act (CCPA) and the New York Stop Hacks and Improve Electronic Data Security (SHIELD) Act. These laws impose similar obligations on restaurants, with penalties for non-compliance ranging from monetary fines to civil liabilities and reputational damage.

Cyber insurance helps your restaurant navigate these ever-evolving laws by covering the costs of legal defense, regulatory fines, and penalties in the aftermath of a cyber incident.

Of course, it’s also a wise move to protect your data by providing your team with training on security practices, conducting regular risk assessments, and creating clear policies for data handling and breach response. You may even want to consider appointing a data protection officer to oversee your restaurant’s compliance efforts.

Get Protected with Coverdash and TouchBistro

Are you ready to get proactive about restaurant cyber security? Through TouchBistro’s partnership with Coverdash, you can now get instant coverage for your restaurant in a matter of minutes. You can even compare quotes from the United States’ largest insurance companies and save as much as 30% on your insurance.

Are you a current TouchBistro Customer?

Not yet a TouchBistro Customer?

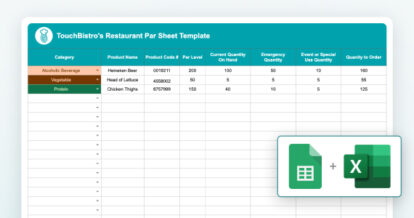

Download our free inventory template

Sign up for our free weekly TouchBistro Newsletter