If you’re in the market for a new POS, you’ve probably discovered that finding reliable information on the best restaurant POS systems can be tricky.

Not only are there dozens of different providers to choose from, but each one has a unique set of features, tools, and services to offer – it’s enough information to make anyone’s head spin. And if you’re a restaurateur, you don’t have the time to scour through company websites and online reviews of the best restaurant pos software just to find the information you need.

To help you cut through the noise and make shopping for a new POS a little less painful, we’ve put together an ultimate guide to the best restaurant POS systems. With in-depth reviews of all the top POS providers (including our own), this guide will help you narrow down the best restaurant POS for your specific business.

In each review, you’ll find:

- A basic overview of each of the top restaurant POS systems

- Each system’s strengths and weaknesses

- Your payment processing options

- Software pricing and other fees

- The ideal restaurant for each POS system

We know that no restaurant POS system is a one-size-fits-all solution, and you need all the information you can get in order to make an informed decision. We hope that with this guide to the best restaurant POS systems, you’ll find the answers to all your burning questions (and then some).

Compare the top restaurant POS systems on features, pricing, payments, and more.

TouchBistro

Overview

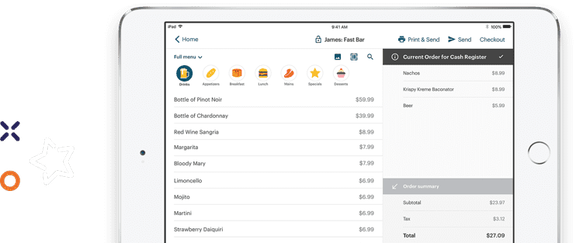

TouchBistro is an all-in-one POS and restaurant management system that enables operators to delight their guests, maximize profitability, and grow their businesses. Designed exclusively with restaurants in mind, TouchBistro provides the most essential front of house, back of house, and guest engagement solutions on one easy-to-use platform.

As the very first company to launch an iPad-based restaurant POS, TouchBistro has been a leader in the restaurant technology space for more than a decade and has become the POS of choice for thousands of single and multi-location restaurants. TouchBistro has even been featured as Gordon Ramsay’s POS system of choice on the hit show Gordon Ramsay’s 24 Hours to Hell and Back

Strengths

TouchBistro’s strengths include:

- TouchBistro is equipped with robust core features and add-on solutions that have been specially crafted to meet the unique demands of running a restaurant, such as taking orders tableside, processing online orders, managing staff, tracking inventory, and more.

- A cloud-based POS that gives operators a centralized, single source of truth for all their operations, data, and reporting, as well as the flexibility to run their business from virtually anywhere.

- Was built exclusively for restaurateurs by restaurant industry veterans, which has resulted in one of the most user-friendly systems on the market.

- Unlike many of the public POS companies, which make decisions in the interest of their shareholders, not their customers, TouchBistro is a private company that always puts the needs of people before profits.

Weaknesses

There are also some drawbacks to TouchBistro, including:

- While TouchBistro is well equipped for growing multi-location businesses, it does not offer the level of customization and flexibility that restaurants with hundreds of locations will require, ultimately making it less suited to international chain restaurants.

- Unlike some POS providers that offer integrations with dozens of different partners, TouchBistro supports integrations for a much more curated list of best-in-class partners.

Payments

Like all the best restaurant POS systems, TouchBistro offers an in-house, fully integrated payment processing solution, TouchBistro Payments. The benefit of using an in-house payment processing solution is that the POS speaks directly to the payment terminals, allowing for a seamless flow of data and eliminating the need for manual entry. This direct integration reduces the risk of order errors (and subsequent chargebacks), while also ensuring a quick and easy payment process for customers.

TouchBistro’s integrated payment processing solution is a particular standout because it’s backed by a trusted financial institution. With TouchBistro Payments, you enjoy access to best-in-class payment processing technology, advanced security, and the support of dedicated payments experts. Not to mention, you also enjoy competitive rates with no hidden junk fees for you or your customers.

Pricing

Not only are TouchBistro’s payment processing fees competitive when compared to similar TouchBistro competitors, but so are its monthly software fees. TouchBistro’s software starts at $69 USD per month for a single license and with each package you get all of TouchBistro’s core POS features, cloud-based POS reports and analytics, 24/7/365 support, and unlimited users and logins for your staff and management.

Like other POS systems, you’ll also have to factor in additional costs to use TouchBistro such as installation, hardware, and payment processing fees. Because TouchBistro is an iPad-based POS system, you may be able to save on some POS hardware costs by reusing your current iPad tablets (as long as it’s a compatible generation).

The Best POS For: Single and Multi-Location Restaurants

With all the POS features you need to run a restaurant, TouchBistro is a great all-around solution for restaurants big and small – from single location operations to restaurant groups and regional chains. And with in-house technology like inventory management, staff scheduling, online ordering, integrated reservations, and more, TouchBistro is one of the best restaurant POS systems for both QSRs and FSRs.

Though TouchBistro can easily support larger, multi-unit restaurants, it’s not equipped with the kind of enterprise capabilities required to support international restaurant chains. For restaurants with these kinds of complex needs, a more bespoke POS solution with extensive third-party integrations may be a better fit.

Want to see TouchBistro in action?

Toast

Overview

Toast is another popular POS system for restaurants. Unlike many other providers, Toast’s all-in-one POS system is built on the Android operating system and requires the use of proprietary Android technology. Beyond its core POS system, Toast also offers an integrated payments solution, which has become a key area of focus since the company went public in September of 2021.

Strengths

Toast’s strengths include:

- Toast bills itself as an all-in-one system, which means the company offers a fairly robust product suite for restaurants, as well as some unique POS features for niche restaurant concepts like pizzerias and hotel restaurants.

- Toast works with an extensive list of best-in-class partners to deliver specialized solutions for restaurants, and even allows operators to build and customize their integrations using Toast APIs.

Weaknesses

Drawbacks to the Toast POS system include:

- Transparency has been an issue for Toast and the company drew industry-wide outrage for quietly introducing a 99-cent fee paid by guests on orders of $10 or higher placed through Toast’s online ordering channels (a decision the company later walked back).

- Toast is an Android system, which is less common in the restaurant industry because the operating system comes with a steep learning curve, and updates are often fragmented due to the variances in available hardware.

- While Toast recently introduced its own reservations management solution called Toast Tables, the solution lacks an online discovery platform for diners to find new restaurants and book a table. This limited reach means that the solution is only useful to restaurants that already have a strong website presence and can expect diners to specifically come to their website to make a booking.

Compare the top restaurant POS systems on features, pricing, payments, and more.

Payments

Toast offers integrated payments with all of its POS packages, making it a one-stop-shop for your POS and payment processing needs. However, it’s important to note that Toast is not compatible with other payment processors, which means you can’t shop around for the best rates.

It’s also worth considering that Toast has a history of making changes to its payments pricing structure with little notice. In addition to the 99-cent fee incident, Toast also quietly raised its processing fees for its small and mid-sized restaurants in September of 2024.

Pricing

When compared to other cloud-based restaurant POS systems, Toast’s monthly software fees are in line with most other providers. Though Toast does have a basic subscription that starts at $0 per month, this package is primarily designed for smaller venues like cafes and coffee shops because it includes more limited features. Toast’s more complete offering is its Point of Sale package, which is better suited to restaurants and starts at $69 per month.

While Toast’s monthly software fees are reasonable, they aren’t the only costs to take into account. Remember that you’re also obligated to use Toast as your payment processor, which comes with its own set of fees. Additionally, you also need to purchase Toast’s proprietary hardware in order to use the POS – something that you might not need to do if you switch from one restaurant iPad POS system to another.

The Best POS For: Niche Restaurant Concepts

With its Android technology, extensive third-party partnerships, and open API, the Toast POS is particularly well suited to niche restaurant concepts in need of a more bespoke and flexible solution. For instance, operators of pizzerias, ice cream shops, and even hotel restaurants will all benefit from the option to customize their POS and add the exact integrations needed for their specific restaurant concept.

But while Toast offers some big benefits for niche concepts, there are a few drawbacks for the average restaurant. With its proprietary hardware requirements, Android operating system, and opaque payment processing fees, the average restaurateur may prefer a solution that allows them to get up and running more quickly and change with them as they grow.

Wondering how Toast compares to TouchBistro?

Read our full review of TouchBistro vs Toast

Square for Restaurants

Overview

Square for Restaurants is restaurant-specific software from the popular mobile payment company Square. Like the company’s other products, Square for Restaurants is designed for simplicity, combining an iOS-based POS system with Square’s signature payment processing services. Though Square itself is available in many countries, Square for Restaurants is only available in the U.S., Canada, Ireland, Spain.

Strengths

Square’s main strengths include:

- The hardware is simple and easy to use, which makes for a quick setup process and ensures that the devices are intuitive enough for virtually any staff member to pick up and learn.

- Square for Restaurants is one of the more affordable restaurant POS systems on the market, with relatively low hardware costs and reasonable monthly software fees (though the features are more limited with the less expensive packages).

Weaknesses

Some of the drawbacks to Square for Restaurants include:

- Square for Restaurants is a much more basic POS system than many of its competitors, meaning its features are less robust and lack some of the unique functions available with other systems.

- Retail actually makes up a significant portion of Square’s customer base – alongside professional services like beauty salons, barbershops, and fitness studios – so Square’s resources are spread extremely thin across the organization and ongoing product development for restaurants is less extensive than you can expect from a restaurant-specific POS provider.

- Square’s bread and butter has always been (and continues to be) small, solo operations and its new multi-location management platform is fairly limited, which means the Square platform is not as well suited to growth as other POS systems.

Payments

When you sign up for Square for Restaurants, you also need to sign up with Square as your payment processor. Not only does this prevent you from using your preferred payment processor, but it also also means you will end up locked in with relatively high payment processing rates. So while Square’s subscription fees may be low, keep in mind that you could still end up with a hefty monthly bill just from all those credit card processing fees.

Compare the top restaurant POS systems on features, pricing, payments, and more.

Pricing

Pricing is one reason why Square for Restaurant may initially be an appealing choice to operators. Unlike most of the top restaurant POS systems, Square does offer a free version of its software with no monthly charges. However, the free version of Square for Restaurants has very limited capabilities and you still need to pay for the necessary hardware and Square’s payment processing services in order to use the system, which means it will end up costing you a whole lot more than $0 per month.

A more comparable offering is Square’s Plus package, which costs $60 per month per location, and $40 per month per added device. This package comes with all of Square’s core POS features, full reporting, and 24/7 support. Though you will still need to account for the cost of hardware and Square’s payment processing fees as well.

The Best POS For: Food Trucks and Cafes

With its affordable monthly software fees and easy iPad setup, Square for Restaurants is one of the best restaurant POS systems for new food service venues that are looking to get up and running very quickly. Square’s simple and streamlined design also makes it a great option for restaurants that process lower ticket items or process a lower volume, such as cafes and food trucks.

However, Square for Restaurants has more limited capabilities than other restaurant POS systems and offers little room for growth. For many FSRs and QSRs – especially those that plan to scale – this means that Square for Restaurants’ POS and reporting features may not be robust enough to support their busy operations.

Wondering how Square for Restaurants compares to TouchBistro?

Read our full review of TouchBistro vs Square for Restaurants

Revel

Overview

Revel is an iPad-based POS system that’s used across North America, and in a number of countries in Europe and Asia. Revel is best known for its robust POS features and its enterprise-level capabilities. The POS system is particularly popular among major multi-unit QSR chains in the U.S.

Strengths

Revel’s strengths include:

- Revel is the POS of choice for some major fast food and fast casual brands because of its impressive range of QSR-friendly solutions, including a dedicated drive-thru solution, a self-service kiosk, and a customer-facing display.

- Revel uses Apple iPads as its POS terminals, which are known for being extremely user-friendly and easy for staff to learn.

See how TouchBistro stacks up

Weaknesses

Some drawbacks to the Revel POS system include:

- Revel’s extensive and complex features can make navigating the software overwhelming and tough for new staff to master.

- Revel’s monthly software fees are some of the highest among other cloud restaurant POS systems.

- The retail side of Revel’s business has become an increasing priority over the years, which may mean less time and resources will be dedicated to restaurants as the company seeks to satisfy both sectors.

Payments

If you want to use the Revel POS system, you also need to use the company’s integrated payment processing solution, Revel Advantage. While this may not be a problem for most operators, the tricky part is that Revel also requires a three-year-long commitment to using Revel Advantage.

Three years is a long time in the restaurant industry, especially if you plan to grow and expand your business. This major upfront commitment can create a somewhat very restrictive situation for operators, because you could end up stuck with a payment processor that doesn’t meet your changing needs.

Compare the top restaurant POS systems on features, pricing, payments, and more.

Pricing

At $99 per month for one terminal, Revel’s monthly software fees are higher than many other POS programs for restaurants. However, this higher cost does mean you get a bit more bang for your buck as all of Revel’s plans come with a robust suite of POS features, reporting and analytics, 24/7 support, and personalized onboarding.

Beyond its monthly software fees, it’s also important to account for the other costs of using Revel’s POS system, including installation fees, hardware, and the payment processing fees for Revel Advantage. While you may be able to offset some hardware fees if you’re switching from another iPad-based POS system, Revel is still one of the priciest restaurant POS systems out there.

The Best POS For: Established Multi-Location QSR Chains

With some of the most robust and customizable POS features out there, Revel is an excellent option for multi-unit establishments, especially major QSR chains. Revel is a particularly great choice for big-name QSR businesses with locations that span the country. QSR brands of this size are sure to benefit from Revel’s robust QSR solutions, including drive-thru technology and a dedicated self-service kiosk solution.

Of course, not every restaurant needs the kind of bespoke POS system that Revel provides. For the majority of FSRs and QSRs, the price of Revel’s POS system may be too steep for features that can’t or won’t be used. Not to mention, Revel’s expensive software, restrictive contracts, and expensive payment processing fees also make the solution a poor fit for growing businesses that need the free cash flow and flexibility to scale quickly.

Wondering how Revel compares to TouchBistro?

Read our full review of TouchBistro vs Revel

Clover

Overview

Clover POS is a cloud-based POS system that runs on an Android operating system and proprietary hardware. Unlike other restaurant POS systems, the Clover system is made up of a series of apps that can be downloaded to meet the needs of restaurants, retailers, and other small businesses.

Strengths

Clover’s strengths include:

- Clover operates its own App Marketplace, which is stocked with a wide variety of in-house, restaurant-specific apps that you can download to customize your system.

- Clover supports a lengthy list of third-party integration partners.

Weaknesses

Weaknesses of the Clover POS system include:

- The free versions of many of the Clover apps have very limited capabilities, meaning you need to pay to access more robust POS features – features that generally come standard on other POS systems.

- Clover runs on its own proprietary Android hardware, which means you have to make a big upfront investment in POS hardware – hardware that you won’t be able to use with another system if you decide to switch providers in the future.

- Unlike many other restaurant POS systems, Clover was not specifically designed for the needs of restaurants, and the system is not equipped with the advanced features or capabilities needed to support some growing restaurants.

Payments

Early on, Clover was acquired by the payment processing company Fiserv (First Data). As a result, Fiserv is the only integrated payments solution that Clover supports. While this means you have a little less flexibility, you also benefit from having a fully integrated payments solution. With Fiserv, you can process payments in-venue, at the table, online, or even over the phone.

Pricing

Depending on the type of restaurant you operate, Clover can be a highly affordable POS solution. The company’s Counter-Service Restaurants package starts at just $54.95 per month for two systems, while its Table-Service Restaurant package starts at $84.95 per month.

In addition to Clover’s monthly software fees, it’s also important to factor in the cost of hardware. As noted, Clover uses proprietary Android hardware, which means that you need to invest in Clover’s hardware upfront in order to use the system. For restaurants that are currently using Apple hardware, this is a major consideration.

The Best POS For: Retail-Focused Restaurant Concepts

With its unique app ecosystem, Clover is one of the most flexible and versatile restaurant POS systems. The unique set up allows restaurants to pick and choose from a wide variety of apps, including extensive retail and ecommerce functions. As a result, Clover is well suited to restaurants that focus more on retail sales, and less on dine-in service. For example, breweries with an in-house taproom and bottle shop.

While Clover’s app-based system is perfect for unique restaurant concepts looking for a bespoke POS solution, it may not be the best restaurant POS software for more traditional restaurants. QSRs and FSRs may find that many of Clover’s apps lack the robust capabilities of the core features found on other restaurant POS systems. As a result, these kinds of venues may quickly outgrow their Clover POS.

Wondering how Clover compares to TouchBistro?

Read our full review of TouchBistro vs Clover

Lightspeed

Overview

Lightspeed is a popular all-in-one POS system that’s used across Canada, the U.S., Mexico, and Europe. Unlike some other POS systems on the market, Lightspeed also sells POS systems for retail and golf courses, in addition to restaurants.

Strengths

Lightspeed’s strengths include:

- Lightspeed primarily runs on an iOS operating system and uses Apple hardware, which is generally considered a more reliable and user-friendly system (though a series of recent acquisitions means that the company now offers an Android option as well).

- In addition to integrations with various third-party payment processors, Lightspeed also offers many third-party integrations with best-in-class partners for services such as payroll, accounting, staff management, marketing, ecommerce, and more.

Wondering how TouchBistro stacks up against the competition?

Weaknesses

Lightspeed’s weaknesses include:

- Lightspeed is not a restaurant-specific POS solution and the company’s broad focus means that there may be less emphasis on continuously improving features for restaurateurs.

- As a public company, Lightspeed’s decisions are largely made in the interest of its shareholders (like its continued expansion into the golf sector), rather than the restaurateurs it serves.

- Some of Lightspeed’s add-on solutions are less robust than others, which means the company relies more heavily on third-party integrations to bridge the gap between its system and each restaurant’s needs.

Payments

In the U.S. and Canada, Lightspeed customers can use Lightspeed Payments, which is an integrated payment processing solution powered by the global payments platform Stripe. This integrated solution allows you to accept payment in-venue, tableside, or online, for a quick and seamless solution.

Operators do have the option to use a third-party processor instead of Lightspeed Payments, but this results in higher monthly software fees. There are also the added headaches of an unintegrated payment solution to consider, such as a less seamless transfer of data and disjointed support.

Compare the top restaurant POS systems on features, pricing, payments, and more.

Pricing

Lightspeed bundles its offerings so you either pay $189 USD for the Essential package, or $399 for the Premium package. The Essential package comes with all the core POS features a single venue restaurant needs, as well as personalized onboarding, basic reporting, free updates, and 24/7 support. On the other hand, the Premium package includes the same basic POS features, as well as multi-location management features.

Keep in mind that while these bundles include all the basic POS features, they don’t include add-on solutions like KDS, accounting, or gift cards. Each of these add-ons will cost you extra (the KDS alone is priced at $40 per month, per screen), so keep this in mind when budgeting how much Lightspeed will set you back each month.

The Best POS For: Restaurants with a Retail Component

With expertise in POS solutions for retail businesses and ecommerce, Lightspeed is an excellent solution for restaurants that also include a retail component, such as breweries with bottle shops, or cafes that also sell groceries. Lightspeed not only offers in-house solutions for these unique restaurant concepts, but it also offers dozens of third-party integrations that allow you to create a bespoke POS solution for your business.

However, for more traditional FSRs and QSRs, Lightspeed may not be the best restaurant POS solution. Lightspeed lacks some crucial in-house solutions that many restaurants rely on for day-to-day operations, such as a well-developed offline mode and advanced CRM options. Additionally, Lightspeed lacks some valuable add-on features, such as in-house reservations, which are important to today’s independent restaurants.

Wondering how Lightspeed compares to TouchBistro?

Read our full review of TouchBistro vs Lightspeed

SpotOn

Overview

SpotOn originally began as a marketing and loyalty platform called SpotOn Transact, and has since transformed into a payment processing and POS software. As a result, SpotOn offers a large suite of in-house, value added services for restaurants, including marketing, loyalty, and review management. However, the company also creates products for a wide range of other businesses, including clothing retailers, auto repair shops, nail salons, plumbers, accountants, and more.

Strengths

SpotOn’s biggests strengths include:

- An extensive suite of in-house, value added services for restaurants, including standard products such as loyalty and online ordering, but also more niche solutions such as a website builder and review management software.

- SpotOn offers competitive payment processing rates through its POS-integrated payments solution, SpotOn with Payments.

Weaknesses

Some drawbacks to SpotOn include:

- SpotOn creates products for a wide range of industries and business types (more than 60% of which are in the retail space), which means there is little focus on continuing to develop and refine the company’s restaurant-specific solutions.

- SpotOn runs on a Windows operating system and requires the use of its own proprietary Windows devices, which is an added expense for many operators, especially those who are hoping to repurpose their existing hardware.

- SpotOn is primarily designed for single-location restaurant operations – particularly those with an integrated retail or ecommerce component – and offers more limited multi-location management for restaurants looking to grow and expand.

Payments

SpotOn offers POS-integrated payments through a plan called SpotOn with Payments. Though SpotOn claims that its integrated payment processing solution comes with competitive payment processing rates, some reviews note that the terms of these contracts are somewhat fuzzy, with SpotOn being granted an abnormally high level of access to merchant accounts.

Pricing

SpotOn bundles its software, so you can choose the solution that best fits your restaurant concept. The Counter Service bundle costs $99 per month, plus $3 per employee, per month, and includes basic POS features such as menu management, reporting, and staff management. There is also a Full Service bundle that costs $135 per month, plus $3 per employee, per month, and includes everything in the Counter Service bundle, as well as digital and tableside ordering features. You also have the option to customize your solution for a custom price.

It’s also worth noting that your monthly software fees are not the only costs to consider. With SpotOn, you also need to factor in the cost of the company’s proprietary Window’s hardware, which is a major expense that you’ll need to make up front, and ongoing integrated payment processing fees.

The Best POS For: Restaurants with a Retail Component

With a wide variety of in-house, value-added services, SpotOn offers a robust and capable POS system. However, many of these add-ons, such as its ecommerce solution, appointment scheduler, and website builder, are more valuable to retailers and other small businesses than restaurants.

As a result, SpotOn is best suited to niche restaurant concepts with an added retail element, such as breweries with an on-site bottle shop or QSRs that also sell some grocery items. These types of restaurants are most likely to get the full benefit of SpotOn’s many integrated tools, while more traditional FSRs and QSRs – especially those with growth and expansion in mind – may benefit from a more dedicated restaurant POS.

Wondering how SpotOn compares to TouchBistro?

Read our full review of TouchBistro vs SpotOn POS

Lavu

Overview

Lavu is an iPad-based POS and payment processing system used by restaurants in more than 90 different countries worldwide. Founded in 2010, Lavu has more than a decade of experience providing restaurant management solutions and boasts more than 300 features and add-on solutions.

Strengths

Lavu’s major strengths include:

- Lavu has gone the extra mile to develop dedicated POS solutions for several niche restaurant concepts, such as pizza parlors, ice cream shops, wineries, and more.

- Customers can choose a hybrid setup because Lavu offers a Local Server option, which ultimately adds a layer of protection against an internet outage (though most cloud-based POS systems also feature a built-in offline mode).

Want to see TouchBistro in action?

Weaknesses

Drawbacks to Lavu’s restaurant POS system include:

- Lavu’s “do it all” approach sometimes means that the quality and depth of its features are not consistent across the board.

- Lavu offers a very limited selection of in-house add-on solutions, and some of the ones it does offer, like inventory management, only include basic features.

- Based on user reviews, Lavu appears to struggle to provide consistent customer service and technical support.

Compare the top restaurant POS systems on features, pricing, payments, and more.

Payments

Lavu offers both an in-house payment processing solution, LavuPay, or the option to use a third-party payment processor. While some restaurants may want the flexibility of choosing their preferred payment processor, LavuPay was designed specifically for restaurants to create an all-in-one solution where everything you need falls under the same umbrella. Lavu also promises top-notch security and 24/7 support for its integrated payment processing solution, which are huge benefits for today’s restaurateurs.

Pricing

When it comes to pricing, Lavu’s software starts at a very reasonable $59 USD per month for a single POS terminal. For this price, you get most of Lavu’s core POS features, including 24/7 support, and real-time sales and labor reporting. Lavu also offers a $129 per month package that includes add-ons like loyalty and online ordering, and a $279 per month package that includes all add-ons and certain integrations like Quickbooks/Xero.

The Best POS For: Highly Specific Restaurant Concepts

With an extensive list of features, numerous third-party integration partners, and optional hybrid setup, Lavu is a good POS option for some restaurants. Lavu is particularly well suited to venues such as pizzerias, ice cream shops, breweries, and wineries because of its highly specialized solutions for niche restaurant concepts.

While Lavu excels when it comes to creating features for very specific restaurant concepts like pizzerias, this “do it all” approach means that some of Lavu’s core POS features are lacking. Instead of focusing on the quality of its core POS features, Lavu seems to prioritize quantity. For many busy QSRs and FSRs, this means that Lavu’s core POS features may not be robust enough to keep up with the demands of day-to-day operations.

Wondering how Lavu compares to TouchBistro?

Read our full review of TouchBistro vs Lavu

Epos Now

Overview

Epos Now is a cloud-based software provider that specializes in POS systems for retail and hospitality businesses. The company is based in the U.K., however, it has since expanded its availability to North America, Australia, and New Zealand.

Strengths

Epos Now’s strengths include:

- Unlike nearly every other restaurant POS system on the market, Epos Now can be run on iOS, Android, or Windows, which means you can choose the operating system and hardware that works best for your particular restaurant and budget.

- Though Epos Now’s basic software package doesn’t include technical support, the system is widely considered an affordable option for restaurants that need a very basic restaurant POS.

Weaknesses

Some of the drawbacks of using Epos Now include:

- The system was designed in the U.K., which means some North America-specific features (like bill splitting) are missing or limited in functionality.

- Support is not included with any of Epos Now’s software packages, meaning you need to purchase a separate technical support package for a minimum of 12-months – a cost that can quickly add up.

- Epos Now was originally designed for retail, so the system lacks many valuable in-house add-on solutions, like labor management, loyalty, marketing, and reservations.

Payments

Unlike some of the major POS providers on the market, Epos Now gives customers some flexibility to use a third-party payment processor or build a custom payments integration using the company’s API. However, it’s important to note that you will need to pay a higher monthly software fee if you don’t use Epos Now’s integrated payment processing solution.

It’s also important to note that if you choose to use a payment processor that’s not integrated with Epos Now, you’ll have to carry out all credit card transactions separately and enter the amounts from each transaction manually into the POS system. For any restaurant that processes a high volume of transactions, this is a major consideration because manually entering each transaction is not only time consuming, but also carries the risk of costly data entry errors.

Pricing

As mentioned already, Epos Now bills itself as one of the most affordable POS systems out there. And if you need a bare-bones POS solution and basic hardware, Epos Now is indeed a budget-friendly option.

But while Epos Now’s monthly software fees may be on the low end, there are other fees to account for. For instance, Epos Now’s software subscriptions do not include technical support, so you have to factor in the added cost of an annual support package. There are also other hidden fees to consider with Epos Now, such as the cost to upload a spreadsheet to the system, and extra fees if you don’t integrate your POS with Epos Now’s own payment processing solution – all of which can add up to make Epos Now a much more expensive option than it initially seems.

The Best POS For: Small-Scale Foodservice Businesses

Based on its affordable pricing, flexible hardware options, and uncomplicated POS features, it’s clear that Epos Now is a good option for small-scale foodservice businesses with relatively straightforward needs. For instance, businesses such as ice cream shops, juice bars, and coffee carts would benefit from a system like Epos Now because it covers all the basics, and won’t weigh you down with advanced features that you may not end up using.

However, if you need to carry out anything more than basic POS functions, you’ll likely find Epos Now inadequate. Epos Now was not originally created for hospitality businesses and many of its restaurant POS features are still limited. Not to mention, Epos Now also doesn’t offer any in-house solutions for add-ons like loyalty or reservations that can help your restaurant scale. For many QSRs and FSRs, a system like Epos Now is likely not robust enough to support a growing restaurant business.

Wondering how Epos Now compares to TouchBistro?

Read our full review of TouchBistro vs Epos Now

The Bottom Line

If there’s one key takeaway from this ultimate guide to the best restaurant POS systems, it’s that no two providers are the same. Each restaurant has its own unique set of needs and POS providers have developed different features, tools, and services to meet those needs. In short, the best restaurant POS for your restaurant will depend on your size, location, type of restaurant, and a wide variety of other factors. But armed with the information in this guide, you should be one step closer to finding the best restaurant POS software for your business.

Compare the top restaurant POS systems on features, pricing, payments, and more.