Tis the season to be… ripping out your own hair.

We’re talking about tax season, of course. Whether it’s here or still on the horizon, it’s never a bad time to prepare for that glorious time of year when we all come together despite our differences and bond over our shared hatred of forms, reports, loopholes, accounting software, and mind-numbing bureaucracy in general.

To help ease the pain, we’re answering a common tax question asked by a lot of restaurant owners each year: Are tips taxable?

The short answer is: Yes. (The long answer is this article.)

To go beyond the question, we break down the biggest issues you need to know about, including:

- Your tip reporting responsibilities as an employer

- Your employees’ tip reporting responsibilities

- The top three tip-related tax myths, busted

- What happens if you fail to report tips

- A how-to guide to running a tip reporting clinic for your employee

- A list of all the relevant IRS forms

- A step-by-step guide to claiming tips come tax time

Act One: Are Tips Taxable?

Tips are defined as discretionary payments of any amount an employee receives from a customer. They include cash tips, as well as tips received through credit cards, debit cards, gift cards, and any other electronic payment options. The definition also applies to tips received from other employees, tip pools, tip splitting, and any other tip sharing agreement.

According to the U.S. tax code, “gross income means all income from whatever source derived.” In other words, tips are considered income and therefore are taxed as such.

Taxing tips began back in 1982 after Congress enacted the Tax Equity and Fiscal Responsibility Act (TEFRA) as a means of generating revenue through a series of tax increases, spending cuts, and other measures. The act requires employees to report tips to their employers, and requires employers to ensure their employees are complying with tip reporting protocol.

An Employer’s Guide to Reporting Employee Tax Income in the U.S.

The employees at your restaurant probably make tips, as is customary in the U.S. As an employer, you have a few responsibilities when it comes to recording and reporting employee tip income, including:

- Withholding employee income taxes, social security, and Medicare taxes based on wages and tip income reported to you by your employees.

- Reporting employee tip income to the IRS.

- Paying the employer share of social security and Medicare taxes based on the total wages paid to tipped employees, including the reported tip income.

- Allocating additional tips to your employees, if the total reported tips are under a certain amount.

- Declaring any allocated tips to your employees.

What Are Allocated Tips?

Allocated tips are amounts you must assign to tipped employees if the total reported tips in a payroll period are less than 8% of your business’ gross sales during the same payroll period (or under a lower rate, if approved by the IRS).

As an employer that operates a large food or beverage establishment, you’re responsible for declaring any allocated tips to your employees to the IRS. A large food or beverage establishment is defined as any establishment:

- Located in the 50 states or District of Columbia

- Where tipping of food or beverage employees by customers is customary

- Where more than 10 employees are employed on a typical business day (based on the preceding calendar year)

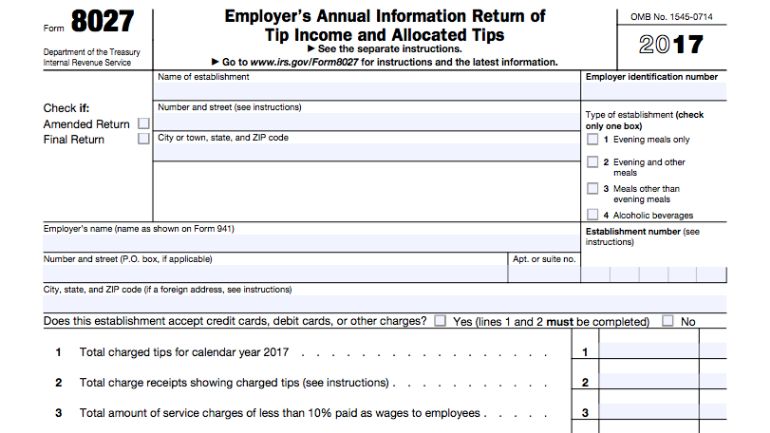

If the total calculated tips reported by all employees equal less than 8% of your gross sales receipts, you are required to allocate the difference among the employees who receive tips. These allocated tips are reported on form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips.

You will need to indicate allocated tips on the employees’ Form W-2, Wage and Tax Statement, in the box titled “Allocated tips.” No income tax, social security, or Medicare taxes are withheld on allocated tips.

An Employee’s Guide to Declaring Tip Income to the IRS

Depending on the state you’re operating in, the minimum server wage can be considerably lower than the general minimum wage. This means your employees rely heavily on tips to round out their income.

And despite this long-standing custom of tipping servers, tax time remains a confusing experience for a lot of people in the service industry.

Tips are considered taxable income by the IRS in the U.S., which means employees earning tips are required to calculate and declare tips when they file their federal income tax.

When it comes to tips, employees are responsible for:

- Keeping track of earned tips

- Keeping track of tip outs to other employees

- Reporting tip income and tip outs to the employer

- Ensuring all tip income, including allocated tip income, is indicated on the Form W-2

- Declaring all tip income when filing federal income tax

Bonus tip: As frustrating as it can be to hand over more money to the taxman, there are many advantages to properly paying tax on tip income. For example, service industry employees are more likely to be approved for loans and mortgages if their tips are being reported because it gives banks a better idea of what the applicant is actually earning and therefore capable of paying.

The 3 Most Common Tax Reporting Myths for Employees

The reason there’s so much confusion about tax time is because you hear mixed messages from people around you all the time. Let’s set the record straight by busting three of the most common tax reporting myths for employees.

1. I don’t make enough money to be audited.

Being audited has nothing to do with how much money you make. People working in the service industry are actually much more likely to be audited because the IRS is aware that tips are often undeclared.

2. I don’t have to pay taxes if I earn less than $20 in tips per month.

It’s easy to see why this is a common misunderstanding around tax time. Although employees are not responsible for reporting tips totaling less than $20 per month to their employer, all tips must be declared as income when filing federal income tax.

3. If I don’t declare my tip income, it’s okay. It’s an innocent mistake.

Purposely undeclared income – including tip income – can be treated as tax fraud, which can incur penalties of up to 75% of the underpayment, in addition to what you owe in back taxes.

Crime and Punishment: What Happens when an Employee Is Caught NOT Reporting Tips

If an employee neglects to declare their tips in full on their federal income tax, it can be considered either negligence or tax fraud, and penalized accordingly. Negligence carries a penalty of up to 20% of the underpayment, while tax fraud – like we mentioned above – can be much higher: up to 75% of the underpayment.

While it’s unlikely to be treated as tax fraud on a first offence, undeclared tips are still risky business.

The reality is that working in the service industry makes your employees more likely to be audited in general. If the amount of tips they’re declaring seems low, their chances of being selected for an audit are much higher.

Not Reporting Tips: But Really, What’s the Worst That Could Happen?

The truth is, neglecting to declare cash tips, while it technically counts as tax fraud, is not likely to land someone in the slammer unless they’re earning some seriously good tips.

That being said, an IRS audit experience can wind up being extremely expensive and stressful.

Here’s an example:

Sam is a server in an upscale restaurant that doesn’t require their staff to report cash tips. As such, she spends several years blissfully unaware that she’s required to do so, until she receives the dreaded notice stating that she’d been selected for an audit.

In Sam’s case, being audited means several thousand dollars in back taxes, interest, fines, and penalties, on top of the cost of hiring an accountant and attorney.

She ends up owing several years in back taxes on the amount determined by the IRS to have been omitted from her reports. She is also responsible for late fees based on when the undeclared tips should have been declared.

All that being said, Sam is lucky. The IRS is lenient and chooses not to assert the 20% penalty under section 6662, which can be applied to those who are deemed to have willfullyunderrepresented their income.

It takes Sam several months to pay off her debt to the IRS. After learning her lesson the really, really hard way, she’s now diligent about tracking and reporting her cash tips.

How to Help Your Employees Report Tips

While it may not be an employer’s explicit responsibility to educate employees about tip reporting, it does help set them – and you – up for a successful and less hair-pulling, migraine-intensive tax season.

Consider setting up reporting protocol and running a clinic or onboarding training for tipped employees to walk them through how to report their income correctly.

We’ve put together the top five things you can include in your tip reporting clinic:

- Explain the rules and regulations related to tipped wages.

- Go through the reporting process in detail with your employees.

- List all of the IRS forms they will receive from you and what information they will need for each form.

- List all of the forms employees will need to submit when they are filing their federal income tax and demonstrate how to fill out each form.

- Determine whether employees prefer to be taxed at source based on wages and tip income combined, or to pay taxes on tip income at year end.

Form Nation: A List of IRS Forms Required for Proper Tip Reporting

It’s no secret that the government loves forms (heart emoji).

For everyone else, fitting your name and address into those tiny little squares either deeply satisfies your A-type personality or makes you want to scream.

So, without further delay, here is a list of all the forms you will need to acquaint yourself with as you prepare to report tip income to the IRS this tax season:

Form 4070: Employee’s Report of Tips to Employer is used by employees to report tips to their employer.

Form 4070A: Employee’s Daily Record of Tips is not required – but it’s a voluntary form designed to assist in the daily tracking of tips received.

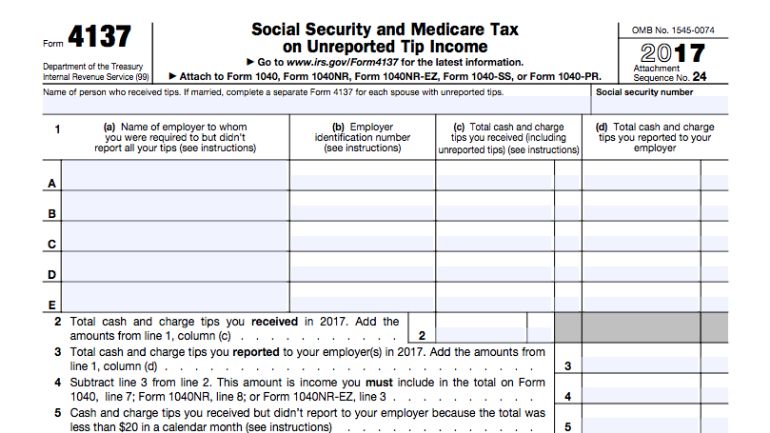

Form 4137: Social Security and Medicare Tax on Unreported Tip Income is used to report any previously unreported tip income to include as additional income on your return.

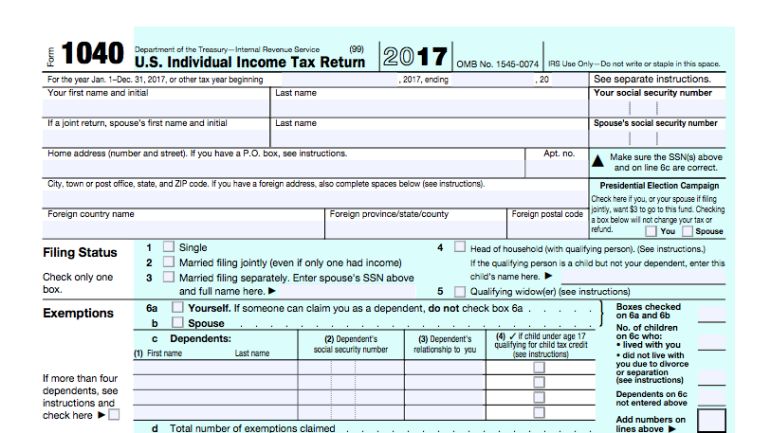

Form 1040: U.S. Individual Income Tax Return for reporting tips allocated by an employer (in box 8 of Form W-2).

Form 8027: Employer’s Annual Information Return of Tip Income and Allocated Tips is the form you as an employer will use to report your employee’s tip income and allocated tip income.

Note: If you operate a multi-unit business, the activity at each separate location is considered to be a separate food and beverage operation and requires its own Form 8027.

How Can Your POS Help with Tip Reporting?

By enabling cash and card tip reporting on your POS for employees who receive tips, you can ease the process of tip reporting for everyone involved by making it part of their daily routine.

As an employee clocks out at the end of their shift, the POS prompts them to enter the dollar amount of cash tips received that shift. The system then generates the number of tips the employee received electronically and determines if the employer owes the employee that amount in cash or vice versa.

Some POS systems also let you generate a Cash Tip Report for a specific employee or certain time period at any time, making tax time that much easier.

By making sure both you and your employees are aware of all the rules and processes around tips and tip reporting, you can ensure that tax season doesn’t also mean hair loss season.

Download your free employee handbook template

Sign up for our free weekly TouchBistro Newsletter