These days, fewer restaurants accept cash than ever before, which naturally has many restaurateurs thinking about how credit card processing works.

Not only are more restaurants going cashless nowadays, but customers also increasingly prefer paying by card. In fact, according to our 2024 American Diner Trends Report, 45% of American diners pay with credit cards when they dine out and 40% of them do so when they take out. This point is even further emphasized in our 2024 Canadian Diner Trends Report, as 64% of Canadian diners pay with credit cards when they dine out and 58% of them do so when they take out. In all cases, using a credit card is the number one payment method.

To help demystify how credit card processing works at restaurants, we spoke with Amy Cargulia, Head of SMB Partner Marketing at J.P. Morgan. Chase Payment Solutions offers payment processing, which means it acts as an intermediary between merchants and credit card networks (like Visa). In fact, Chase is the payment processor behind TouchBistro Payments Powered by Chase. Amy has worked at Chase for 20 years, where she currently oversees its partner marketing strategy and execution across all types of partners, including those that leverage their payment processing APIs, like TouchBistro.

We recently spoke with Amy to learn more about how credit card processing works in restaurants and what operators need to know about accepting non-cash payments. Keep reading to get her expert insights.

How Does Credit Card Processing Work in a Restaurant?

If you’ve ever paid your check at a restaurant with a credit card, you’re familiar with what happens next.

“The server takes the card and swipes it through a machine that reads the card’s information,” Amy says.

But what’s happening behind the scenes? What’s the card reader checking for?

“This information is sent to a payment processor, which checks if the customer has enough funds and communicates with the restaurant’s bank account to transfer the payment amount,” she explains.

So, if a customer’s check is for $35, the payment processor verifies that the customer can make a $35 payment without exceeding their credit limit. If that’s the case, the payment is approved. If not, then the transaction is rejected.

Does the Process Differ if the Guest Uses a Different Payment Type?

So what happens if a customer pays with a debit card or mobile payment method instead of with a credit card?

“When a customer pays with a credit card at a restaurant, the restaurant typically swipes or inserts the card into a credit card reader or terminal, which verifies the card and processes the payment. Debit card payments are similar, but require the customer to enter their PIN,” Amy says.

Entering a personal identification number (PIN) on the keypad proves that the person using the debit card is indeed its authorized user, which reduces fraud. Providing a signature is another way for customers to verify card ownership, although signing a receipt is becoming an increasingly uncommon practice.

In addition to debit cards, some customers may also choose to pay via mobile payment. Mobile payments are processed slightly differently than credit and debit card payments at a restaurant.

“Mobile payment methods, such as Apple Pay or Google Wallet, use near-field communication (NFC) technology to transmit payment information from the customer’s mobile device to the payment terminal,” Amy says.

In other words, NFC technology wirelessly transfers data and authorizes payments between these two devices.

How Do Online Payments Work?

Some restaurants may also receive credit card payment online if they offer online ordering.

Restaurants with direct online ordering platforms rely on online payment technology to process credit and debit cards. Payment gateways are the secret behind how to process online payments and receive credit card payments online. A gateway is the interface that collects a customer’s payment information, while a payment processor relays that information to the credit card provider to release funds.

“In the restaurant industry, online payment processing typically involves customers making payments through a restaurant’s website or mobile app using a payment gateway,” Amy says.

Because online payments are a card-not-present transaction – meaning the cardholder does not have or cannot physically present their card – the gateway provides security to decrease fraudulent card use and chargebacks.

A chargeback happens when a credit cardholder gets a card transaction reversed because they contested the transaction for suspected fraud, or a number of other reasons. Because merchants are charged a fee for every chargeback investigation, it’s in their best interest to minimize chargebacks as much as possible.

“In-person payment processing, on the other hand, involves customers physically presenting their payment method to a restaurant employee, who then processes the payment using a point-of-sale (POS) system or other payment terminals,” Amy says.

What Role Does a Payment Processor like Chase Play in Processing Transactions?

You know that accepting a card payment involves a card, a restaurant POS system, and a card reader. So what role does a payment processor play?

“A payment processor like Chase is the link between merchants and credit card networks such as Visa or Mastercard. Chase provides the technology and infrastructure necessary to securely transmit payment information, verify cardholder details, and facilitate the authorization and settlement of transactions between merchants and issuing banks,” Amy says.

In other words, using a payment processor is the easiest and most efficient way to accept credit card payments in your restaurant.

What Are the Benefits of Partnering with an Institution Like Chase for Payment Processing?

While you’ll encounter a lot of options when researching how to receive a credit card payment, choosing a big name can be very beneficial for restaurants.

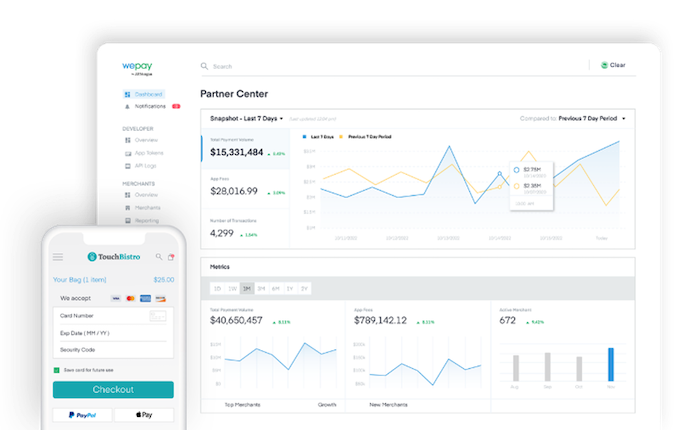

“Partnering with Chase for payment processing offers several benefits for restaurant operators, including faster and more secure transactions, access to a range of payment options, streamlined accounting and reporting, and improved customer experience,” Amy explains. “Additionally, partnering with a trusted financial institution like Chase can provide peace of mind and support for businesses looking to grow and thrive in a competitive industry. Our WePay technology empowers platforms and software innovators to grow, diversify revenue and create custom payment processing experiences.”

J.P. Morgan and Chase gives its clients the best of both worlds. Amy says payment processing is “backed by J.P. Morgan’s global scale and security, along with Chase’s small businesses’ expertise.”

What Should Restaurateurs Look for in a Payment Processing Partner?

With lots of payment processors on the market, it can be difficult to discern what your business really needs. Amy advises looking for a payment processing partner that fits the following four criteria:

- Transparent pricing: According to TouchBistro’s 2025 State of Restaurants Report, lack of transparency in pricing is one of the top frustrations restaurateurs experience when it comes to payment processors. Look for one that charges you the true cost for in-venue transactions and a fixed rate for online transactions, without surprise fees.

- Secure payment processing: Your payment processor needs to offer the latest security features, like end-to-end encryption, to protect your business and its customers.

- User-friendly technology: Find a solution that’s simple for your staff and customers to use. It should have a comprehensive onboarding process for your team and come with 24/7 support and online resources for troubleshooting. Your payment processor should also let your customers pay tableside using any payment method they’d like, including mobile wallet payments.

- Fits your restaurant’s specific needs: There’s no one-size-fits-all solution for payment processing, so Amy suggests looking for one that can support the restaurant’s specific payment needs, like tableside payment options and integration with your existing POS.

With the help of this checklist, you’ll be able to find the right payment processor for your restaurant in no time.

What to Avoid

Of course, knowing what to avoid when shopping for payment processing partners is just as important as knowing what to look for. Amy advises staying away from solutions that:

- Have high transaction fees

- Mandate long-term contracts

- Come with poor customer support

- Offer limited payment options

- Have slow processing times

All of these items are red flags that could end up costing you time and money down the line.

What Factors Would Change a Restaurant’s Payment Processing Needs?

Your business is an ever-changing entity and your payment processor must be able to keep up. You may eventually reach a point when you may need to change your payment technology, especially if your restaurant is growing and scaling quickly.

“Several factors can impact a restaurant’s payment processing needs, including the size and volume of transactions, the types of payment methods accepted, the need for mobile payment solutions, the level of security required, and the restaurant’s location and target customer demographics. Technology and industry trends may also affect a restaurant’s payment processing needs over time,” Amy says.

For example, TouchBistro’s 2023 report found that 76% of restaurants introduced mobile pay technology. If you notice lots of customers asking if you accept Apple Pay or Google Pay and your current processor isn’t compatible, it might be time to find a new solution.

Why Should You Choose a Payment Processor That Integrates with Your POS?

There are two types of payment processors: ones like TouchBistro Payments Powered by Chase that integrate and share data with your POS, and standalone systems that can’t do either of those things.

According to TouchBistro’s research, the number one payment processing frustration for venues with a standalone payments solution is manually entering transactions. You can avoid this time-consuming, error-prone chore by using an integrated processor, Amy advises.

“Choosing a payment processor that integrates with your POS system can provide several advantages, including streamlined checkout processes, faster transaction times, reduced errors, and improved data accuracy. Additionally, it can simplify accounting and reporting tasks, enable better inventory management, and enhance customer experience,” she says.

TouchBistro Payments Powered by Chase is a three-in-one hardware, software, and support solution that allows you to accept payments of all types in your restaurant. Designed to keep your business moving, TouchBistro Payments integrates directly with the TouchBistro POS to reduce the burden of double entry and features a built-in offline mode so you can continue taking payments even if your internet goes down. And with simple, transparent pricing, you never have to worry about surprise payment processing fees.

The Top Payments Processing Trends to Watch

During our chat, Amy offered a wealth of knowledge on the current state of payment processing. But what should restaurateurs keep an eye on in the future?

“In recent years, there has been a significant shift towards digital payment methods in the restaurant industry. This includes contactless payments, mobile payments, and online ordering systems. Additionally, many restaurants now offer payment options such as Apple Pay, Google Pay, and other e-wallets to accommodate customers’ preferences for cashless transactions. The COVID-19 pandemic has also accelerated the adoption of these payment methods due to safety concerns,” she says..

Cash is no longer king in the restaurant industry. With credit card, debit card, and mobile payments gaining popularity, it’s important for restaurateurs to understand how credit card processing works to choose the best payment processor for their needs.

Whether you’re reevaluating your existing payment processor or shopping for a new one from scratch, we hope Amy’s expert insights will help you find an ideal system. Look for a solution like TouchBistro Payments Powered by Chase that integrates with your POS and offers transparent pricing, user-friendly technology, and best-in-class security features.

Learn how to save money on payment processing fees

Sign up for our free weekly TouchBistro Newsletter