There are three topics you should avoid bringing up at a dinner party: politics, religion, and tip pooling.

Tip pooling and tip sharing have been a controversial part of the hospitality industry for quite some time.

More recently, tip sharing gained media attention due to changes in federal legislation regulating who can participate in the tip pool and how. Leaving the politics for Capitol Hill, we’ll explain what these tip pooling laws mean for restaurant owners and managers.

In this article, you’ll learn:

- What tip pooling is

- Tip pooling vs. tip sharing

- Tip pool distribution ideas

- How tip pooling laws have changed in 2018

- Tip pooling rules by state

- How to set up tip pooling at your restaurant

- Tip pooling pros and cons for employers

What Is Tip Pooling?

Tip pooling is the practice of tipped employees combining their tips at the end of a shift and sharing them with other restaurant staff in a predetermined way.

Tip redistribution is often contained to the servers who contributed tips to the pool. But some restaurants choose to include non-tipped staff members such as food runners, hosts, or bussers.

Earlier in 2018, new legislation rolled back a previous requirement that tip pools not include untipped staff. So now restaurants can also include back-of-house staff like chefs and dishwashers in the tip pool.

Federal law still prohibits restaurant owners, managers, or any other supervisor-level staff to take tips from employees.

This means you, as a restaurant owner or manager, can’t take tips from the tip pool.

Tip Pooling vs. Tip Sharing

The phrases “tip pooling” and “tip sharing” are often used interchangeably and can refer to the practice of putting tips together and redistributing them among restaurant staff.

But, historically, “tip pooling” has referred to redistributing tips only among tipped employees (servers, bartenders, etc.), while “tip sharing” referred to redistributing tips among both tipped and untipped staff (chefs, dishwashers, etc.).

Now that you have a basic knowledge of what tip pooling is and how it’s conducted, we can dive deeper into everything you need to know about the laws that govern tip pooling.

Note: We are not lawyers (obviously). You should always seek professional legal counsel before implementing or making changes to your restaurant’s tip sharing policy.

Tip Pool Distribution: What’s the Best Way to Do It?

While federal laws regulate who can participate in the tip pool (see below), they don’t dictate how it’s collected or distributed among your employees. There is no “maximum contribution amount or percentage on valid mandatory tip pools,” so it’s up to you to set the protocol at your restaurant.

Here are some of the most common ways tips are split among staff who participate in the tip pool at restaurants.

Evenly: Tips are collected and then redistributed evenly among eligible staff.

Service benchmarks: Tips are split based on number of hours/shifts worked or number of tables served.

Proportionally based on room served: If you run a large restaurant with multiple rooms, it’s likely that some rooms will be more lucrative with tips than others (patio vs. bar, etc.). You may want to pool and redistribute tips on a per-room basis to eligible employees.

Contest: A tip bonus is given to one eligible employee or shared among a team for breaking a record or meeting a goal (serving the most tables, bringing in the most tips per room, etc.).

Proportionally based on roles: If you include service staff and untipped employees in your tip pool, you may want to redistribute the tips in different proportions. For example, in California, 80% of the tips in a pool generally go to servers, 15% to bussers, and 5% to bartenders.

However you choose to redistribute tips, please note that restaurant staff must be notified of your tip pooling practices before participating in them.

Five Things Employers Need to Know about Tip Pooling

Forgive us. Things are about to get a tad technical.

Note: It’s a good idea to refer back to these five points as you read the rest of the article.

1. Employers must notify employees of the restaurant’s tip pool policy in advance of the employees’ participation in it.

2. As of March 2018, employees who are not customarily or regularly tipped, like cooks or dishwashers, can participate in tip pools.

3. If an employer claims a tip credit to make up the difference between an employee’s cash wage and the federal minimum wage, the credit can’t be higher than what the employee receives (from direct tips, tip pools, and allocated tips).

4. Restaurant owners, managers, and supervisors are not allowed to take their employees’ tips; therefore management cannot receive tips distributed from the tip pool.

5. State and local laws may override federal regulations, so check local laws to make sure you are following the rules.

Now that you have this handy cheat sheet on tip pooling laws, we’ll dive deeper into recent changes.

How Have Federal Tip Pooling Laws Changed?

In March 2018, the Consolidated Appropriations Act made some changes to federal regulations on tip pooling.

Starting with the old laws, let’s translate the legal jargon into plain, ol’ English for you and explain what’s changed.

But first, some review to help you navigate these laws:

What is a tip credit?

The federal minimum wage is $7.25 per hour. In many states, restaurants can pay tipped employees a reduced cash wage, or tipped minimum wage, of $2.13 per hour so long as the employees’ tips bring their hourly wage up to the federal minimum wage. This is referred to as the tip credit provision of the Fair Labor Standards Act (FLSA). If an employee’s wages do not add up to the federal minimum wage after tips, the employer must make up the difference.

Who is considered a “tipped employee”?

The FLSA defines tipped employees as those who “customarily and regularly receive more than $30 per month in tips.”

You can read more about tip credits and tipped employees in our article on The State of Tipped Minimum Wage in the Restaurant Industry.

Old tip pooling laws (pre-2018)

- Tip pooling was NOT allowed if tipped employees were paid the federal minimum wage of $7.25 per hour and if employers did not claim a tip credit.

- Employees who were NOT customarily tipped or in the “chain of service” (chefs, janitors, dishwashers, etc.) were NOT allowed to receive tips from the tip pool.

- Managers and supervisors were NOT allowed to participate in tip pooling.

Current tip pooling laws (as of March 2018)

- Tip pooling is allowed whether or not employers claim a tip credit, as long as employee wages (tipped minimum wage plus the tip credit) add up to at least the full FLSA minimum wage of $7.25 per hour.

- Employees who are customarily not tipped (such as dishwashers, janitors, or cooks) can now receive tips from the tip pool.

- Managers and supervisors are still NOT allowed to participate in tip pooling.

- Your state may have laws that override federal laws (explained in a section below).

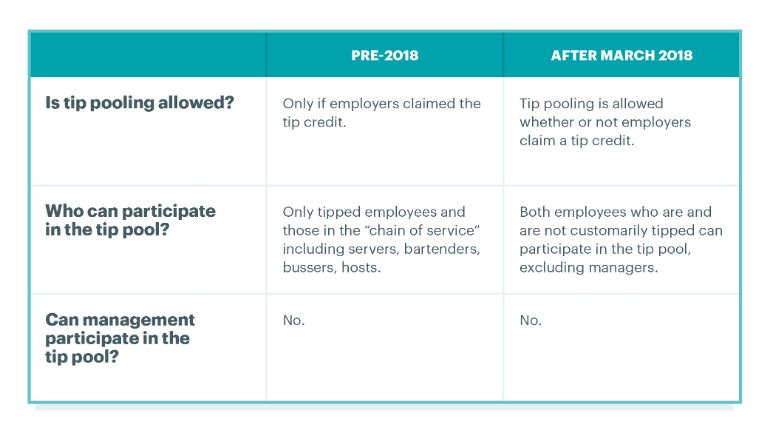

Pre-2018

Is tip pooling allowed?

Only if employers claimed the tip credit.

Who can participate in the tip pool?

Only tipped employees and those in the “chain of service” including servers, bartenders, bussers, hosts.

Can management participate in the tip pool?

No.

After March 2018

Is tip pooling allowed?

Tip pooling is allowed whether or not employers claim a tip credit.

Who can participate in the tip pool?

Both employees who are and are not customarily tipped can participate in the tip pool, excluding managers.

Can management participate in the tip pool?

No.

State Exceptions to Tip Pooling Laws

Your state or municipality may have regulations that are stricter than those at the federal level.

Here are some state-specific tip pooling laws that override federal laws. It’s a good idea to consult with your legal counsel to make sure that you’re following local laws.

New York tip pooling laws

In New York state, untipped employees can only participate in the tip pool if they regularly contribute to customer service as part of their roles. This includes servers, bartenders, food runners, hosts, bussers, and barbacks, for example.

Additionally, New York state has a higher combined tipped employee minimum wage than the federally mandated minimum, and a lower minimum cash wage than the federal minimum. You can learn about the state’s schedule for raising the minimum wage to $15 per hour here.

California tip pooling laws

Restaurant employers in California cannot claim tip credits for their employees. They must pay their tipped employees the state minimum wage of $10.50 per hour or $11.00 per hour (depending on how many employees work at the restaurant) before tips.

California tip pooling laws state that only restaurant employees in the “chain of service” (servers, bussers, bartenders, etc.) can participate in a tip pool.

Also, tips from the tip pool must be redistributed in a “fair and reasonable” manner that respects the amount of service each employee provided to the customer. The ratio of 80% to waiters, 15% to bussers, and 5% to bartenders has been deemed fair and reasonable by the California Department of Labor Standards Enforcement.

Other states/territories that require employers to pay tipped employees the state minimum wage before tips:

- Alaska

- Guam

- Minnesota

- Montana

- Nevada

- Oregon

- Washington

Texas tip pooling laws

In Texas, employers can’t force tipped employees to share tips with employees who do not participate in the service of guests (such as janitors, cooks, dishwashers).

But if tipped employees choose to share their tips with untipped employees (excluding management), they may – as long as these tips are not claimed by the employer as tip credits.

Restaurant employers in Texas can only require employees to contribute tips in excess of the amount they receive to meet state minimum wage to the tip pool.

Illinois tip pooling laws

While Illinois has no specific tip pooling laws, it does have a higher state minimum wage ($8.25), which affects how much in tips an employee must earn on top of a cash wage before they can contribute to the tip pool.

How to Implement Tip Pooling at Your Restaurant

Want to start tip pooling at your restaurant?

Here are some guidelines for getting started.

1. Check with a lawyer. Make sure that you know the federal, state, and local regulations associated with tip pooling in your area.

2. Do your research. Talk to restaurant owners in your area who run similar businesses and have similar service needs. Full service restaurants are top-of-mind when it comes to tip pooling, but cafes and quick service restaurants with communal tip jars also need a plan for redistributing tips. And never forget to talk to your servers! Tip pooling can affect staff morale, so you’ll need to know how they feel about tip pooling policies. With employee turnover rates in the hospitality industry at 70%, you’ll need to keep your staff happy to make sure they stay.

3. Determine whether or not you’ll be taking a tip credit. Review your finances to determine whether you should pay your staff your state’s full minimum wage, or if you’ll pay tipped employees a cash wage and subsidize the rest with a tip credit. If you choose to take a tip credit, you’re required to notify your employees that you are.

4. Create a tip pooling agreement form. Get employees to read and sign the form.

Tip Pooling: Pros and Cons for Employers

Not sure if you should implement tip pooling at your restaurant?

Here are some tip pooling pros and cons to help you decide.

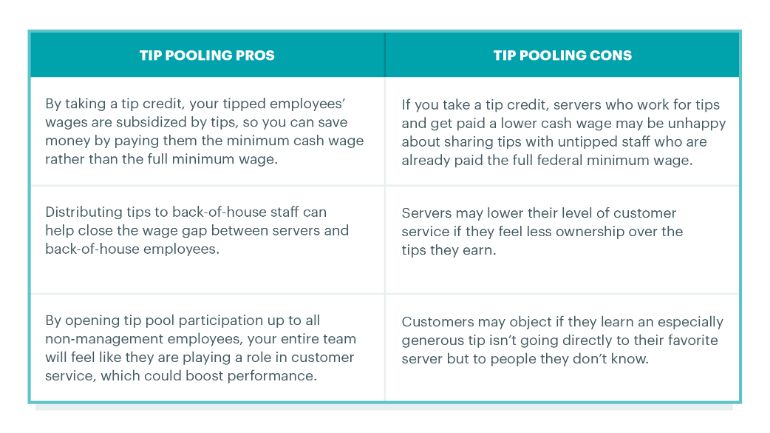

Tip Pooling Pro

- By taking a tip credit, your tipped employees’ wages are subsidized by tips, so you can save money by paying them the minimum cash wage rather than the full minimum wage.

- Distributing tips to back-of-house staff can help close the wage gap between servers and back-of-house employees.

- By opening tip pool participation up to all non-management employees, your entire team will feel like they are playing a role in customer service, which could boost performance.

Tip Pooling Con

- If you take a tip credit, servers who work for tips and get paid a lower cash wage may be unhappy about sharing tips with untipped staff who are already paid the full federal minimum wage.

- Servers may lower their level of customer service if they feel less ownership over the tips they earn.

- Customers may object if they learn an especially generous tip isn’t going directly to their favorite server but to people they don’t know.

If it’s available in your area, tip pooling can help lighten your financial load as an employer and can also lead to greater cooperation between your employees. Just remember to take the time to consider what’s best for your restaurant and go about it legally – and always consult your servers. You can’t operate your restaurant without good staff, so make sure to put their needs first.

Download your free employee handbook template